Multiple Type Taxes Like in India

Multiple Type Taxes Like in India

3 years 4 months ago - 3 years 4 months ago #17

by admin

Multiple Type Taxes Like in India was created by admin

Introduction

After implementation of GST, There are many user has trouble to work with GST Filling and Taxation to their companies. Especially, the indian GST FrontAccounting Supports well. Let’s go with simple and easier to understand.Say for example, if your business has 18% GST, than your SGST – 9%, And CGST – 9%. you need to show them both in your Customer Sales invoice to pay tax. Let’s go with this example and set GST on FrontAccounting.GST SetupFrom the FrontAccounting(FA) setup menu,you might seen the below options.

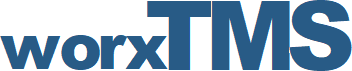

Indian GST Tax Types

Navigate to your FA and login and goto Setup ->Tax Types. Here you have to define the SGST and CGST. The below screenshot helps you to define them. And before coming to this page. Our COA Must be ready to use. Here I have two COA’s for Sales and Service.

Here the default rate is wrong. But you need to specify both of them 9% as of my example. And hope you know the Tax details to set it up here.

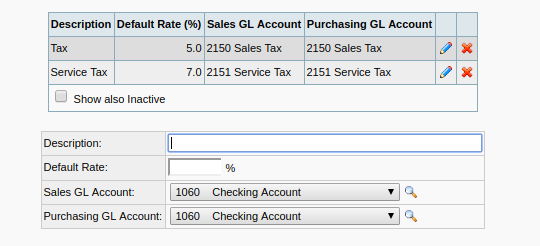

Tax Groups

Defintely we need tax group to apply both SGST and CGST. Check the below screenshot you will understand the procedure to setup the tax group

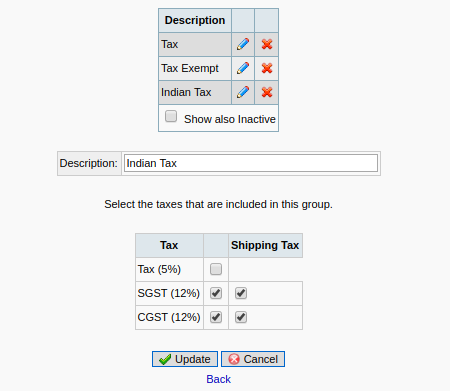

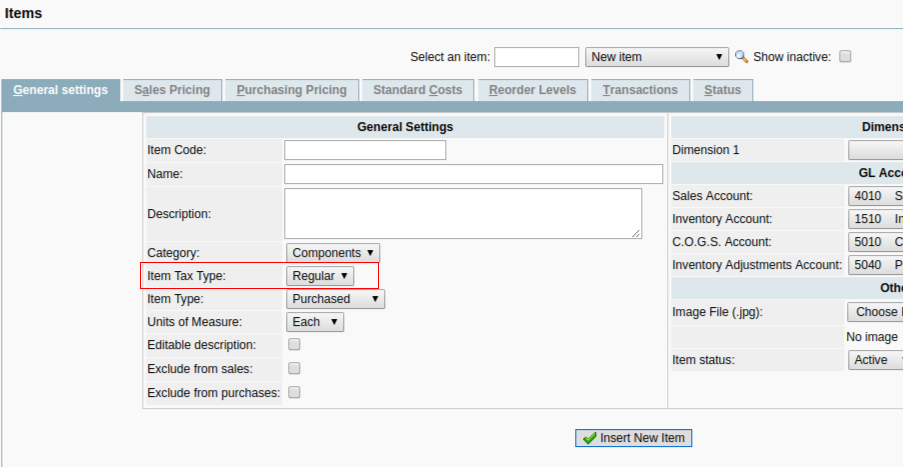

Item Tax Types

The Item tax types helps to define the tax better way to each products. Hope the below screenshot helps you to set it up.

Its fine to define the tax types. Let’s start using them properly. Here are some additional details to use tax.

Tax on Inventory Creation

While creating new inventory, you might have chance to select the Items tax type, that we defined above. You can use that to create it .There is a screenshot for your understanding.

Tax on Customers and Suppliers

You can see the Tax Group on both suppliers and Customers profile page. With that you can define the Taxed and Non Taxed Suppliers and Customers. There is one more thing for customers. Included Tax and Excluded Tax.The tax applied with its price is called Included Tax. The excluded Tax is something just opposite. The tax rate is applied after the price and its quantity added to Sales Invoice Table. Hope this article helps you to setup and start using the the Taxes in india,

After implementation of GST, There are many user has trouble to work with GST Filling and Taxation to their companies. Especially, the indian GST FrontAccounting Supports well. Let’s go with simple and easier to understand.Say for example, if your business has 18% GST, than your SGST – 9%, And CGST – 9%. you need to show them both in your Customer Sales invoice to pay tax. Let’s go with this example and set GST on FrontAccounting.GST SetupFrom the FrontAccounting(FA) setup menu,you might seen the below options.

- Tax Types

- Tax Groups

- Item Tax Types

Indian GST Tax Types

Navigate to your FA and login and goto Setup ->Tax Types. Here you have to define the SGST and CGST. The below screenshot helps you to define them. And before coming to this page. Our COA Must be ready to use. Here I have two COA’s for Sales and Service.

Here the default rate is wrong. But you need to specify both of them 9% as of my example. And hope you know the Tax details to set it up here.

Tax Groups

Defintely we need tax group to apply both SGST and CGST. Check the below screenshot you will understand the procedure to setup the tax group

Item Tax Types

The Item tax types helps to define the tax better way to each products. Hope the below screenshot helps you to set it up.

Its fine to define the tax types. Let’s start using them properly. Here are some additional details to use tax.

Tax on Inventory Creation

While creating new inventory, you might have chance to select the Items tax type, that we defined above. You can use that to create it .There is a screenshot for your understanding.

Tax on Customers and Suppliers

You can see the Tax Group on both suppliers and Customers profile page. With that you can define the Taxed and Non Taxed Suppliers and Customers. There is one more thing for customers. Included Tax and Excluded Tax.The tax applied with its price is called Included Tax. The excluded Tax is something just opposite. The tax rate is applied after the price and its quantity added to Sales Invoice Table. Hope this article helps you to setup and start using the the Taxes in india,

Last edit: 3 years 4 months ago by admin.

Please Log in or Create an account to join the conversation.