FrontAccounting Integration – Free Accounting Software for Transport Companies

Transport Management Software FrontAccounting

Connect worxTMS with FrontAccounting, the Free Accounting Software System for Transport and Logistics Companies. This integration automates invoicing, synchronizes drivers, vehicles, and customers, and keeps your transport operations perfectly aligned with accounting.

Combine the power of a Transport Management System and Free Accounting Software for Transport in one seamless solution — run your business efficiently and professionally.

Watch: FrontAccounting Integration Overview -- Coming Soon***

🚀 Benefits of FrontAccounting Integration

- Automated invoice generation from TMS shipments and POD uploads

- Sync customers, drivers, vehicles, and carriers seamlessly

- Access accounting inside worxTMS without separate login

- Support for multiple fiscal years, tax groups, and currencies

- Secure hosting and support provided by worxTMS for free

- Professional accounting for transport companies at no extra cost

ℹ️ About FrontAccounting

FrontAccounting is a Free Accounting System for Transporters. worxTMS hosts it on secure servers and provides integration support. Our help focuses on syncing invoices, drivers, vehicles, and customers. For advanced accounting setup or guidance, visit the FrontAccounting Official Website.

- Hosted on secure servers for reliability

- Integration includes invoices, customers, drivers, and vehicles

- Combine TMS + Free Accounting Software in one platform

- Demo Account: Username: FrontAccounting, Password: T.B.A

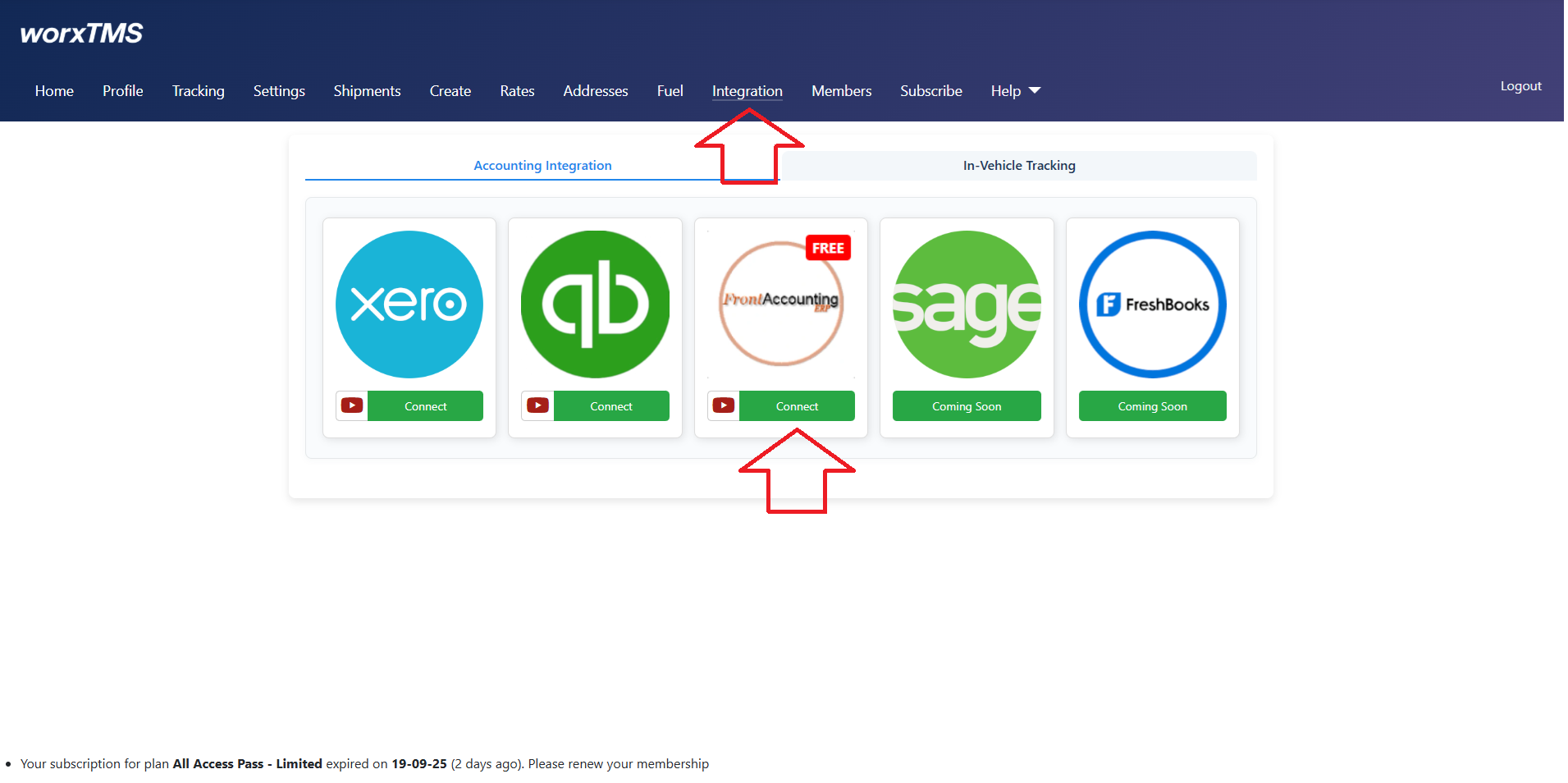

🚧 Connect FrontAccounting with worxTMS

This page and integration are under active development. Transport companies will soon manage invoices, customers, drivers, vehicles, and carriers seamlessly inside worxTMS.

- Complete your "Settings" page setup before clicking Connect

- Go to "Integrations" on the top menu

- Click "Connect" — worxTMS will create your FrontAccounting account

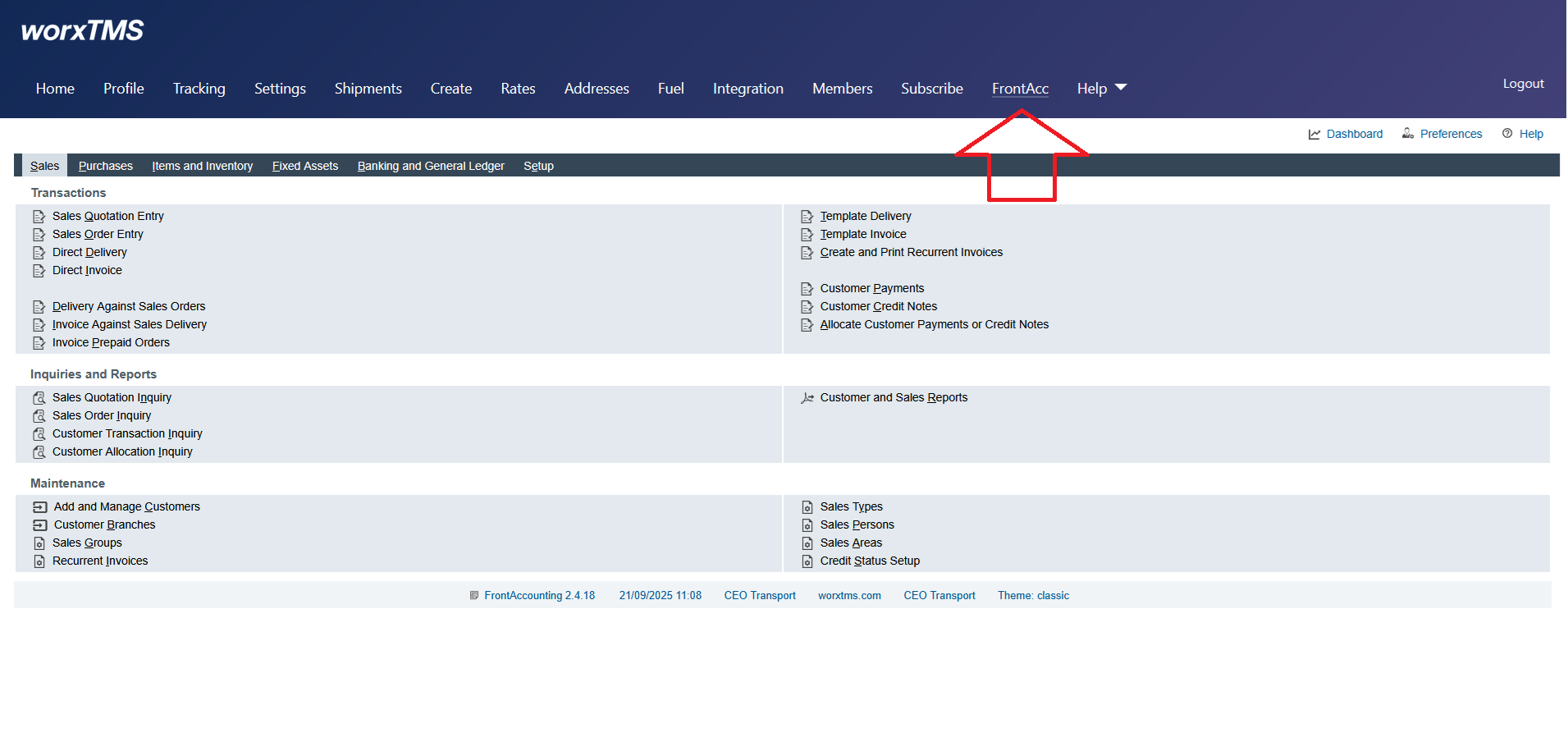

- Extra menu item "FrontAcc" will appear

- Click "FrontAcc" to access FrontAccounting inside worxTMS via iframe — no separate login needed

Click the "FrontAcc" menu item to use FrontAccounting directly inside worxTMS. All features are available without separate login.

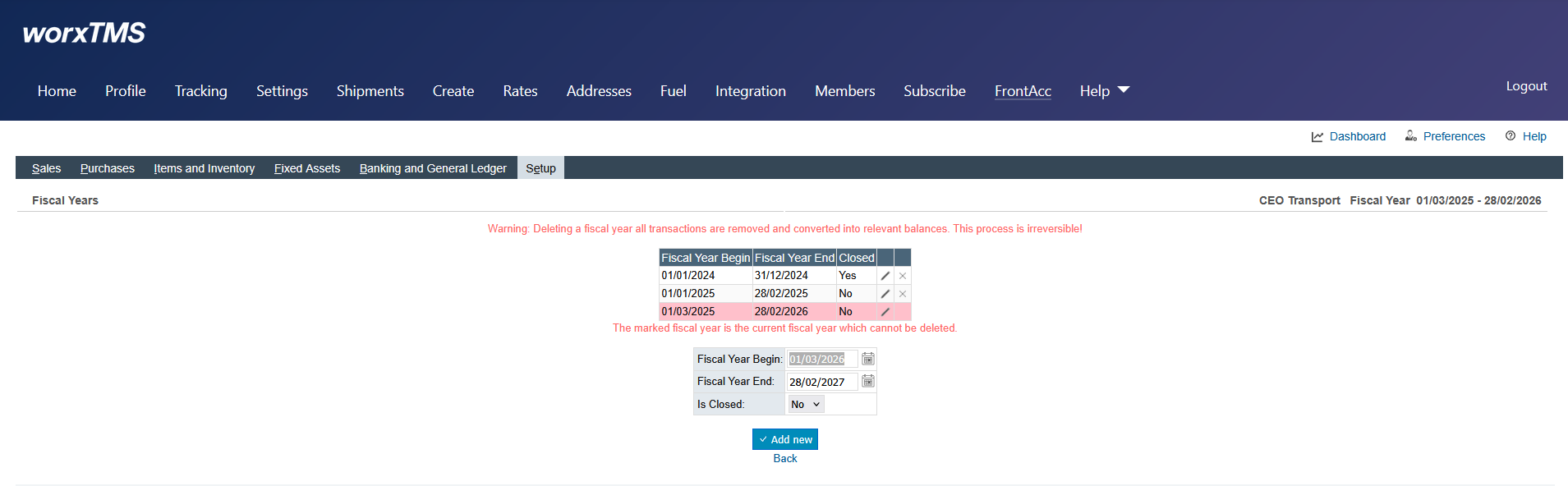

Setup → Fiscal Years

Fiscal Years separate accounting periods. They usually follow calendar years (Jan 01 - Dec 31) but can be broken years. Initial prolonged years are possible depending on country rules.

Procedure

Create a new Fiscal Year via Setup → Fiscal Years, set active Fiscal Year in Setup → Company Setup. Adjust starting Fiscal Year as needed, delete unused years, then set the correct year as active.

- Create short dummy years if necessary to align with legal starting periods

- Close and delete old or unused fiscal years

- When year-end arrives, create a new Fiscal Year

- Switch Fiscal Year via company setup as needed

- Closed years can no longer accept entries; balances roll over to retained earnings

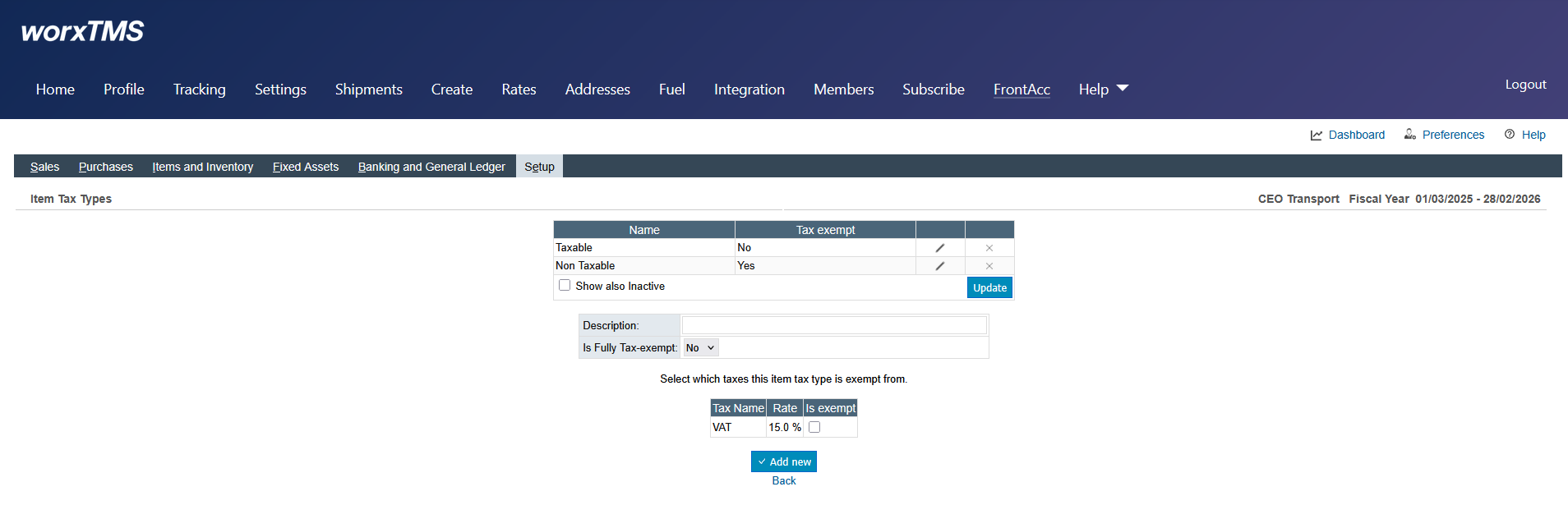

Setup → Item Tax Types

Add Taxable and Non Taxable types. You can create multiple Item Tax Types per VAT/GST rules, allowing you to assign taxes selectively.

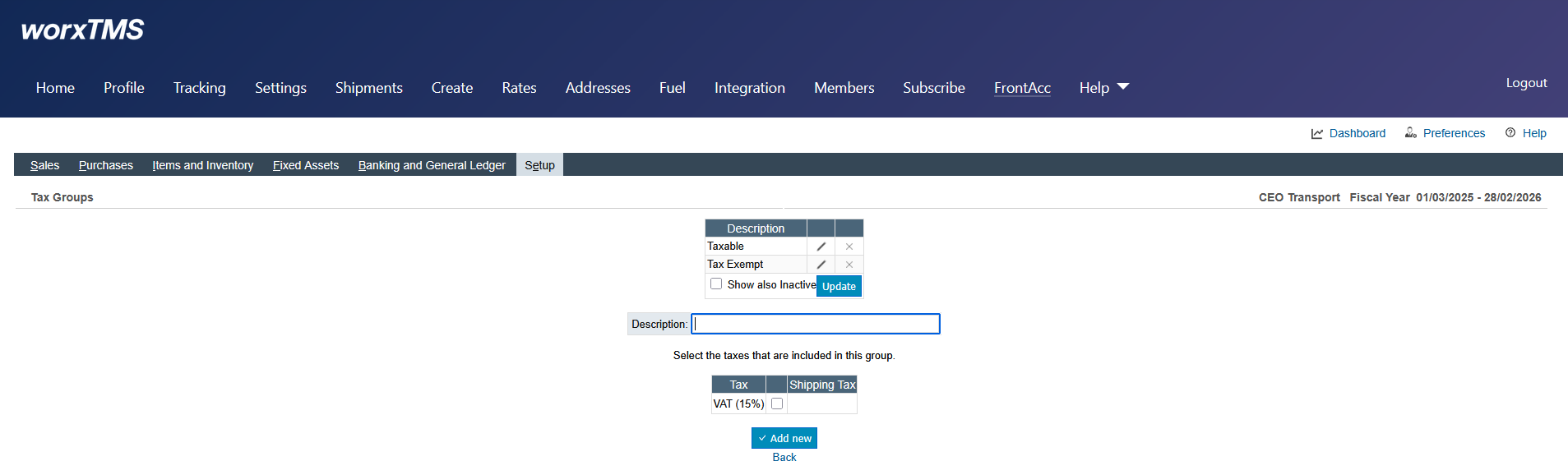

Setup → Tax Groups

Tax Groups bundle multiple tax rates. For transport companies, simplest setup:

- Taxable – VAT/GST applied

- Tax Exempt – no tax applied

Allows easy management without configuring every invoice manually.

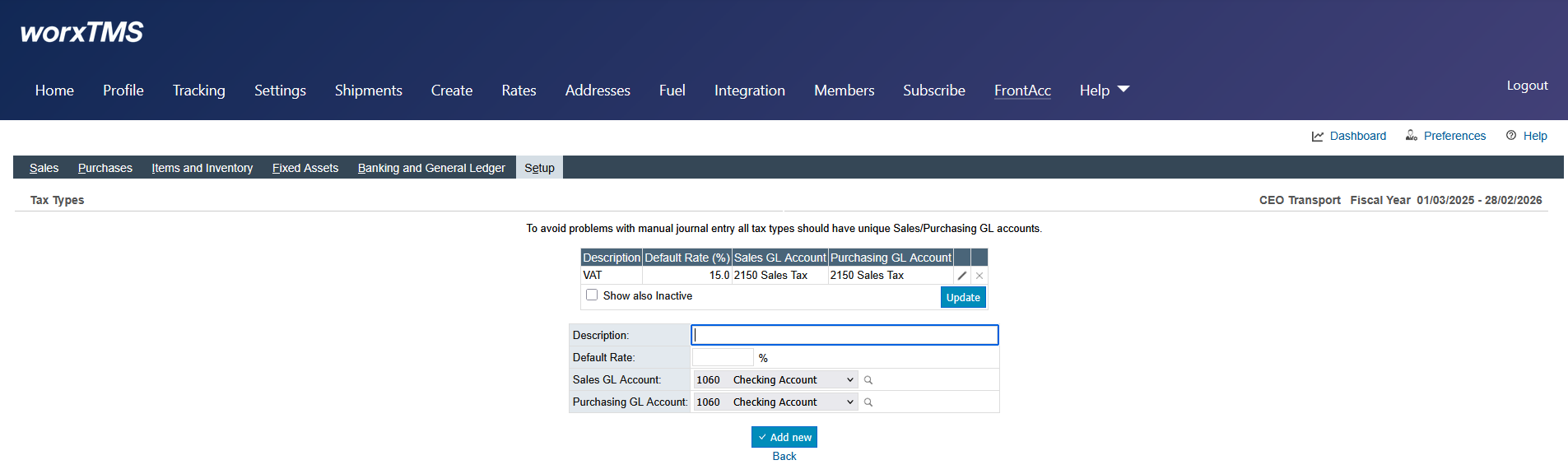

Setup → Tax Types

Define taxes like VAT, GST, or Sales Tax. Specify rate percentages and descriptions. Tax Types link into Item Tax Types and then into Tax Groups.

- Example: VAT 15%, VAT 0%, GST 5%

- Each company defines its own Tax Types per legislation

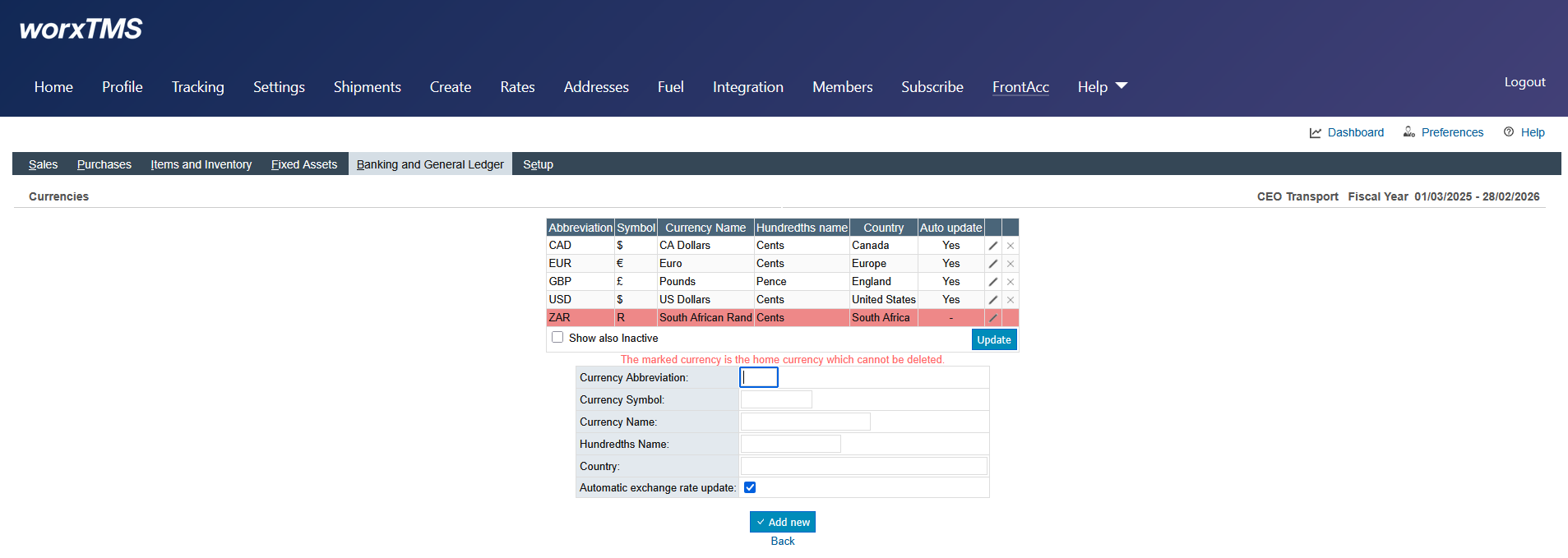

Setup → Currencies

Manage currencies under Banking and General Ledger. Set home currency, add foreign currencies, update exchange rates, and mark inactive currencies when no longer used.

- Home Currency: base currency (e.g., USD, EUR, ZAR)

- Foreign Currencies: used for supplier/customer transactions

- Exchange Rates: update as rates change

- Transactions in foreign currencies convert automatically to home currency